I spoke with the San Diego Union-Tribune about the rise in prices compared to last year. Over the last year we have seen a steady increase in home prices. They have reached a new peak at $585K, up 8% from last year. This change may be due to the low interest rates we continue to see. This has helped more buyers purchase homes and it has driven competition. The low interest rates have been driven by many factors, to read about this and more click here.

September Real Estate Market Update

I wanted to share a quick update with you about what I have observed in the housing market. Below you can find a video where I discuss the trends we have seen.

One of the many observations is of course interest rates. They are still low, but what does it mean for you? If you are contemplating a refinance or purchase, now may be the time to act. Along with low interest rates, there are many loan programs available that may meet your financing needs.

Watch the video below for more information and let me know when I can help put together a plan for you.

What Is Zillow Offers?

Zillow Offers is a new program that has arrived in San Diego. This new program offers to help homeowners sell their home faster. While this may sound appealing to sellers, the downside is the price point. Zillow Offers may not pay what some sellers would like. Their offer comes in at market value and not typically higher. This may be good for sellers who are simply ready to move on from their current home for various reasons and are not too concerned with getting the highest offer. It’s also an opportunity for sellers who are not interested or cannot afford to make any renovations or changes to their home that would garner a higher offer. So while there are benefits to this program, it is not for everyone.

I spoke with some news outlets about this program. You can check out the articles here and here. Some San Diego realtors also offer their opinion on this program and it’s definitely worth the read.

What Is An Appraisal?

Down below is a short vide explaining the importance of an appraisal in the home buying process. An appraisal can help to give you a better idea of the value of your investment in a home. For any questions you may have, reach out to me I’m happy to help!

Is Now The Time To Refinance?

I spoke with Bloomberg about the rise of refinancing we have seen.

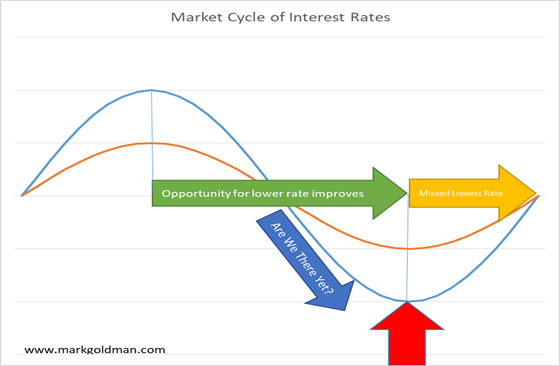

Market timing is always an issue in the real estate and financing business. Although many expect rates to continue to decline, we do not know where the bottom will be. But, when people wait to see the bottom, they jump into the market AFTER the moment of greatest opportunity. In this case, lowest interest rates. In addition, they forgo the time that they would have enjoyed a lower interest rate by seizing a good market opportunity NOW.

Rates go up and they go down. We do not know the how much or when they move. Here are two alternative scenarios with more change and less change in interest rates. In an ideal world, we want to hit the bottom, marked with the red arrow. I my opinion, it is better to seize a rate opportunity as rates decline rather than miss an opportunity as rates are increasing. I have also observed that rates increase faster than they decrease in past cycles.

I think now is a great time to review mortgage debt and evaluate a refinance. Let me know how I can help you.

For the full article, click here.

San Diego Real Estate Market Update

Hello everyone, I wanted to share a market update video now that we are well into the second half of the year. Some of the topics I discuss are the slowing down of the market and what that can mean for the overall state of the market. I still think it’s a good time for buyers due to the decreasing we have seen in interest rates. Watch the video down below and let me know how I can help you!

Commercial Real Estate Workshop

If you have been wanting to learn more about commercial real estate and how to analyze transactions, I’d like to invite you to join this upcoming workshop. I will be presenting this class along with Curtis Gabahrt, president of Gabhart Investments who has been very successful in the commercial real estate industry. We will be covering many topics all about commercial real estate. Make sure to get your tickets soon, you can purchase them here.

Now Licensed In Arizona

Hello everyone, I’m happy to announce that I am now a Licensed Loan Originator in Arizona. Along with working in California I’m looking forward to helping clients and brokers in this new market. Many California residents have invested in property in Arizona because of the rising market and great investment opportunities. Whether you’re looking to invest or to make the big move to our neighbor state, I’m happy to help.

What To Do During The Application Process

Submitting your loan application does not mean the process is done. There is still a lot of reviewing that needs to happen to finally close the loan. If you are in this phase of the home buying process, there are steps you can take to ensure the loan will close and you will be funded for your purchase. Watch the video below for three easy steps you can take. Like always, I’m happy to help with any questions you may have.

Benefits Of Working With A Mortgage Broker

Working with a mortgage broker has many benefits over acquiring a mortgage with a big bank. Not only can we find the better rates, but we can help make sure buyers have more purchasing power. This can be essential in the San Diego market because of the competition brought on by the low inventory of homes. Getting pre-approved is always a great first step in your home search.

To read the full article click here.